kentucky sales tax on-farm vehicles

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. Sales Tax 45000 - 2000.

Kenworth Trucks For Sale In Kentucky 32 Listings Truckpaper Com Page 1 Of 2

In Kentucky certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

. Of course you can also use this handy sales tax calculator to confirm. Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title.

It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Payment shall be made to the motor vehicle owners County Clerk. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base. TRUCK PART DIRECT PAY AUTHORIZATION KRS 13948032a exempts truck repair and replacement. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered.

If a business that will provide one of the new taxable services has no doubt but that it will exceed the 6000 de minimis threshold we recommend collecting the tax beginning on. Effective January 1 2023 limousine service providers are subject to a 6 excise tax on the gross receipts of vehicle rentals peer-to-peer car sharing rentals ride share services. To ensure the tax collected from the sale of motor vehicles to residents of states which do not allow Kentucky residents to purchase motor vehicles without paying that.

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. 1 Hand tools or wholly hand-operated equipment including. Motor vehicles gasoline and special fuels are exempt from sales and use tax but subject to excise taxes imposed pursuant to KRS Chapter 138 KRS 139470.

The use tax works in conjunction with the sales. The Governor signed an executive order that will stop an increase in vehicle property taxes caused by soaring used car values which in Kentucky rose approximately. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats.

Answers To Common Agriculture Tax Exempt Questions Lifestyles Somerset Kentucky Com 2 State Farm Liability Auto Insurance In 2021 State Farm Insurance Insurance. Kentucky businesses must collect a 6 percent sales tax on certain services and retail sales of digital property and tangible personal property. Calculate Car Sales Tax in Kentucky Example.

Commonly used on farms the sale or purchase of which shall not be exempt from the sales or use tax as provided by KRS 139480. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Several exceptions to the state sales tax are goods and machinery which.

Part of gross receipts subject to the Kentucky sales tax per KRS 13901010. Items that can be purchased sales tax free for legitimate farm use. Are services subject to sales tax in Kentucky.

How To File And Pay Kentucky Kyu Weight Distance Tax Step By Step Youtube

Time Has Come For U S Farms To Cut Methane Emissions Agriculture Secretary Reuters

Form 51a270 Fillable Certificate Of Sales Tax Paid On The Purchase Of A Motor Vehicle

Kentucky Hay And Farm Equipment For Sale

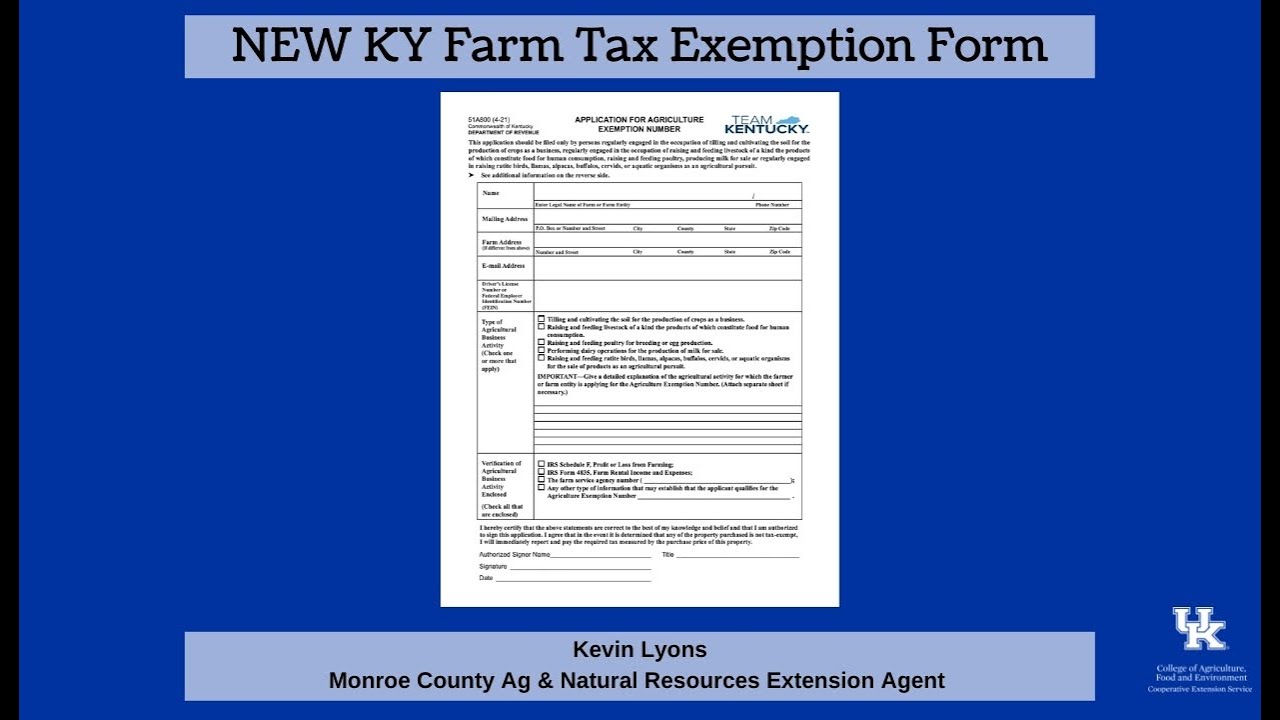

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

How This Farmer S Amazon Career Helps Him Feed His Community

Sales Use Tax Department Of Revenue

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Ag Prepares For Electric Powered Future

Ford Brothers Fall Farm Machinery Vehicles Equipment Recreational Vehicle Online Consignment Auction

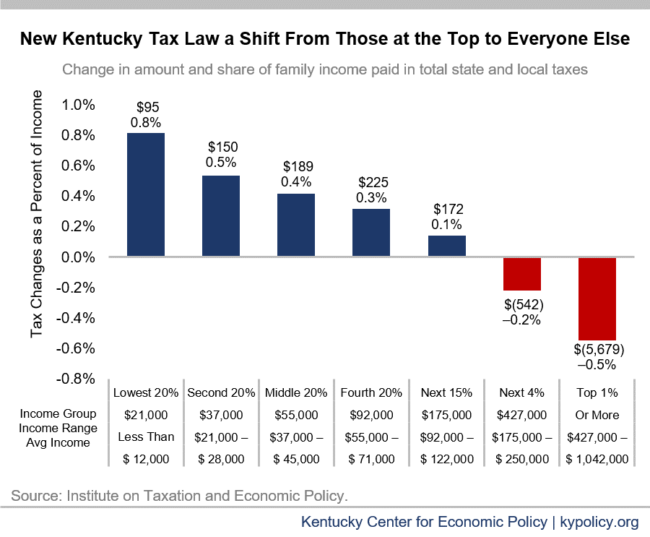

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Tangible Personal Property State Tangible Personal Property Taxes

Tax Season The Schedule F And Why It Is Important Kentucky Center For Agriculture And Rural Development

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Kentucky S Car Tax How Fair Is It Whas11 Com

Kentucky Solar Farm Invite Is Not Sitting Well With Rural Neighbors